Bitcoin and Ethereum Stuck in Range, DOGE and XRP Gain

April 25, 2025

1. Introduction

The tag “newly mined bitcoin volumes” refers to the amount of freshly created bitcoin that has been added to the circulating supply.

2. Importance

Understanding the newly mined bitcoin volumes is crucial for analyzing the overall supply dynamics of the cryptocurrency market. It provides insights into the rate at which new bitcoins are being introduced, which can impact the market price and investor sentiment.

3. Technical Background

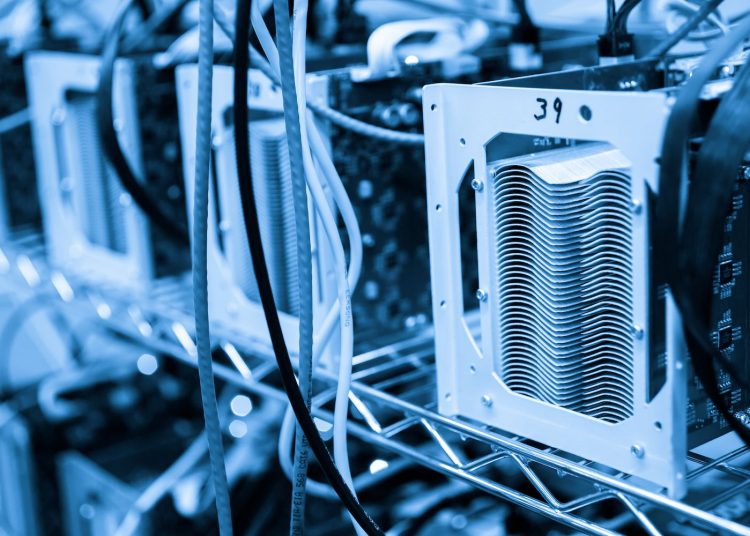

Bitcoin mining is the process by which new bitcoins are created and added to the blockchain. Miners use specialized hardware to solve complex mathematical puzzles, verifying transactions and securing the network in exchange for newly minted bitcoins. The newly mined bitcoin volumes can fluctuate based on factors such as mining difficulty, block rewards, and network hash rate.

4. Usage

Traders and analysts can use the data on newly mined bitcoin volumes to assess the overall health of the bitcoin network and predict potential price movements. Low volumes of newly mined bitcoin may indicate a decrease in miner activity or market demand, while high volumes could suggest increased network security and growing interest in bitcoin.

5. Risk Warning

It is important to note that fluctuations in newly mined bitcoin volumes can be influenced by various external factors, such as regulatory changes, technological advancements, and market speculation. Traders should exercise caution and conduct thorough research before making any investment decisions based on this data.

6. Conclusion

In conclusion, monitoring the newly mined bitcoin volumes can provide valuable insights for investors and traders in the cryptocurrency market. By staying informed about the supply dynamics of bitcoin, individuals can make more informed decisions and navigate the market with greater confidence. Further research into this topic is encouraged to deepen understanding and enhance trading strategies.

1. How does the volume of newly mined bitcoins compare to existing bitcoins?

Newly mined bitcoins are currently added at a rate of 6.25 every 10 minutes, while existing bitcoins continue to circulate in the market.

2. Can the volume of newly mined bitcoins affect the overall supply and demand dynamics of the market?

Yes, an increase in newly mined bitcoins can potentially lead to an oversupply, which may impact the price of bitcoin in the market.

3. How does the volume of newly mined bitcoins impact the mining community?

As the block reward decreases over time, miners may need to rely more on transaction fees to sustain their operations.

4. Is there a limit to the total number of bitcoins that can be mined?

Yes, there is a maximum supply of 21 million bitcoins that can ever be mined, with over 18 million already in circulation.

5. Will the volume of newly mined bitcoins continue to decrease over time?

Yes, the block reward is programmed to halve approximately every four years, leading to a gradual reduction in newly mined bitcoin volumes.

User Comments

1. “I’m curious to see how the market will respond to the influx of newly mined bitcoin volumes.”

2. “It’s always fascinating to track the fluctuations in newly mined bitcoin volumes.”

3. “I wonder if the increase in newly mined bitcoin volumes will impact the value of existing coins.”

4. “I’m excited to see how the growing interest in cryptocurrency will affect newly mined bitcoin volumes.”

5. “The competition for newly mined bitcoin volumes must be intense among miners.”

Weekly Bitcoin (BTC) purchases by Strategy have little to no measurable effect on BTC’s market price, according to VanEck’s head ...

Read more© 2025 Btc04.com