Bitcoin and Ethereum Stuck in Range, DOGE and XRP Gain

April 25, 2025

1. Introduction

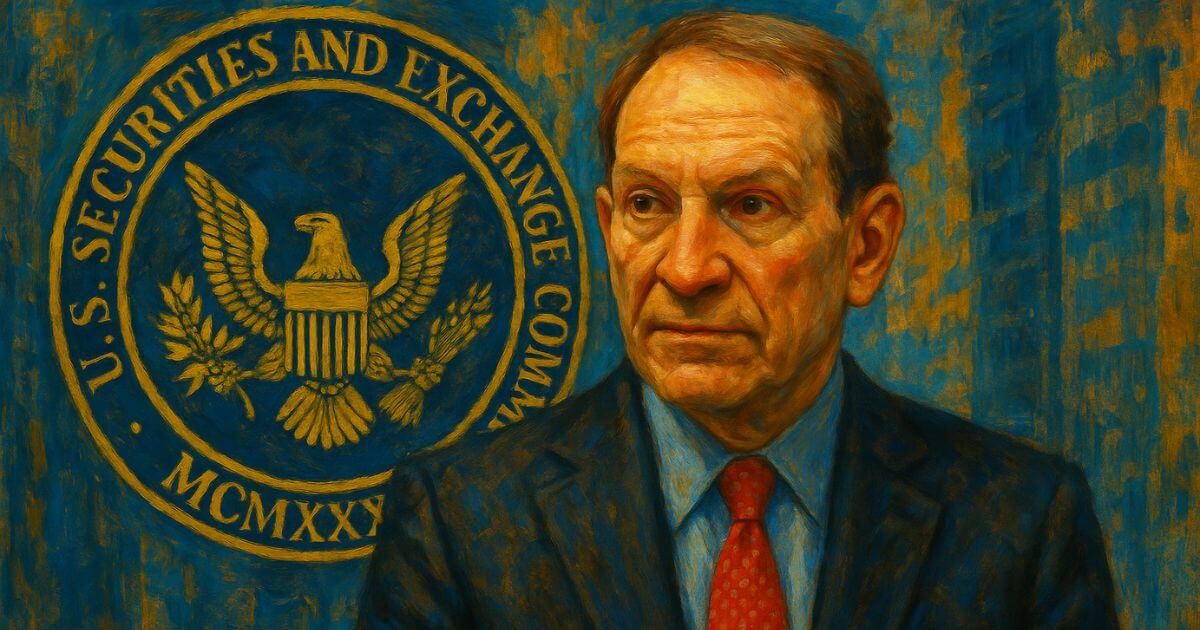

The recent SEC decisions to terminate actions in the cryptocurrency industry.

2. Importance

The SEC’s decisions to terminate actions in the cryptocurrency industry play a crucial role in shaping the regulatory landscape for digital assets. This can have significant implications for market participants, investors, and the overall adoption of cryptocurrencies.

3. Technical Background

The Securities and Exchange Commission (SEC) is a regulatory body in the United States responsible for enforcing federal securities laws. When the SEC decides to terminate actions related to cryptocurrencies, it can signal a shift in regulatory priorities and provide clarity on how existing regulations apply to digital assets.

4. Usage

For traders and analysts in the cryptocurrency industry, keeping track of the SEC’s decisions to terminate actions can provide valuable insights into regulatory trends and potential market impacts. By monitoring these developments, market participants can make more informed decisions when trading or investing in cryptocurrencies.

5. Risk Warning

While the SEC’s decisions to terminate actions can bring clarity to the regulatory environment, there are still risks associated with investing in cryptocurrencies. Market volatility, regulatory uncertainty, and potential fraud are just a few of the risks that investors should be aware of when participating in the cryptocurrency market.

6. Conclusion

In conclusion, staying informed about the SEC’s decisions to terminate actions in the cryptocurrency industry is essential for navigating the regulatory landscape and making informed investment decisions. Continued research and monitoring of regulatory developments will be key to staying ahead in this ever-evolving industry.

Question: What are recent SEC decisions to terminate actions?

Answer: The SEC has recently terminated actions against companies for violations of securities laws due to lack of evidence or settlement agreements.

Question: Why would the SEC terminate an action against a company?

Answer: The SEC may terminate an action if there is insufficient evidence to support the allegations or if the company agrees to settle the matter.

Question: Can the SEC reopen a terminated action in the future?

Answer: Yes, the SEC has the authority to reopen a terminated action if new evidence comes to light or if the company violates the terms of a settlement agreement.

Question: How do terminated actions impact the reputation of a company?

Answer: While a terminated action may not result in formal charges, it can still have negative implications for a company’s reputation and investor confidence.

Question: Are terminated SEC actions public information?

Answer: Yes, terminated SEC actions are typically public information and can be accessed through the SEC’s online database or press releases.

User Comments

1. “Finally some common sense prevailing in the SEC! Terminate those unnecessary actions and focus on more important issues.”

2. “I’m disappointed to see some actions being terminated, especially if they were aimed at protecting investors. Hope they have a good reason for this decision.”

3. “It’s always a mixed bag with the SEC decisions. Sometimes it feels like they’re cleaning house, other times it’s just bureaucratic red tape.”

4. “I wonder what prompted the SEC to terminate these actions. Transparency is key in these types of decisions.”

5. “As an investor, I hope the SEC is making the right call in terminating these actions. We rely on them to keep the market fair and safe.”

The U.S. Securities and Exchange Commission will host another crypto regulation roundtable on April 11, attracting participation from executives and ...

Read more© 2025 Btc04.com