Bitcoin and Ethereum Stuck in Range, DOGE and XRP Gain

April 25, 2025

1. Introduction:

Funds managed by refers to the pool of capital managed by a professional entity or individual within the cryptocurrency industry.

2. Importance:

Having funds managed by a reputable entity can provide investors with access to diversified portfolios, expert management, and potentially higher returns in the volatile cryptocurrency market. It offers a more hands-off approach for investors looking to benefit from the growth of digital assets without actively managing their investments.

3. Technical Background:

In the cryptocurrency industry, funds managed by are typically structured as investment funds, hedge funds, or managed accounts. These entities leverage their expertise in market analysis, trading strategies, and risk management to generate returns for their clients. They play a crucial role in providing liquidity, stability, and professional guidance to the market.

4. Usage:

Investors can utilize the information about funds managed by for research purposes, due diligence, and decision-making in their investment strategies. By analyzing the performance, track record, and investment approach of these funds, investors can make informed choices about where to allocate their capital for potential growth and risk mitigation.

5. Risk Warning:

While funds managed by offer potential benefits, investors should be aware of the risks involved. These may include market volatility, regulatory changes, fraud, and mismanagement of funds. It is essential to conduct thorough research, perform due diligence on the fund manager, and assess the investment strategy before committing capital to any fund.

6. Conclusion:

In conclusion, funds managed by play a significant role in the cryptocurrency industry by providing professional management and diversification opportunities for investors. It is essential for investors to carefully consider the risks and rewards associated with these funds and conduct thorough research before making any investment decisions in this space.

1. What does it mean when a company receives funding from funds managed by a financial institution?

When a company receives funding from funds managed by a financial institution, it means that the money comes from the pool of assets managed by that institution for investment purposes.

2. Are there any restrictions on how companies can use funds managed by a financial institution?

Typically, there are no specific restrictions on how companies can use funds managed by a financial institution. However, the terms of the investment agreement may include certain guidelines.

3. How can companies access funds managed by a financial institution?

Companies can access funds managed by a financial institution by submitting a proposal or business plan for investment consideration by the institution’s fund managers.

4. What are the advantages of receiving funding from funds managed by a financial institution?

Receiving funding from funds managed by a financial institution can provide companies with access to capital, expertise, and networking opportunities that can help drive growth and success.

5. Is it common for companies to seek funding from funds managed by financial institutions?

Yes, it is common for companies to seek funding from funds managed by financial institutions, as these institutions often have large pools of capital available for investment in promising businesses.

User Comments

1. “Impressive to see the results from funds managed by this company, they really know how to make smart investments.”

2. “I always feel confident when my money is in the hands of funds managed by this team, they consistently outperform the market.”

3. “From funds managed by this firm, I’ve seen steady growth in my portfolio over the years. Highly recommend their services.”

4. “I’ve had a great experience with funds managed by this organization, they have a strong track record of success.”

5. “It’s reassuring to know that my investments are in good hands with funds managed by this group. Trustworthy and reliable.”

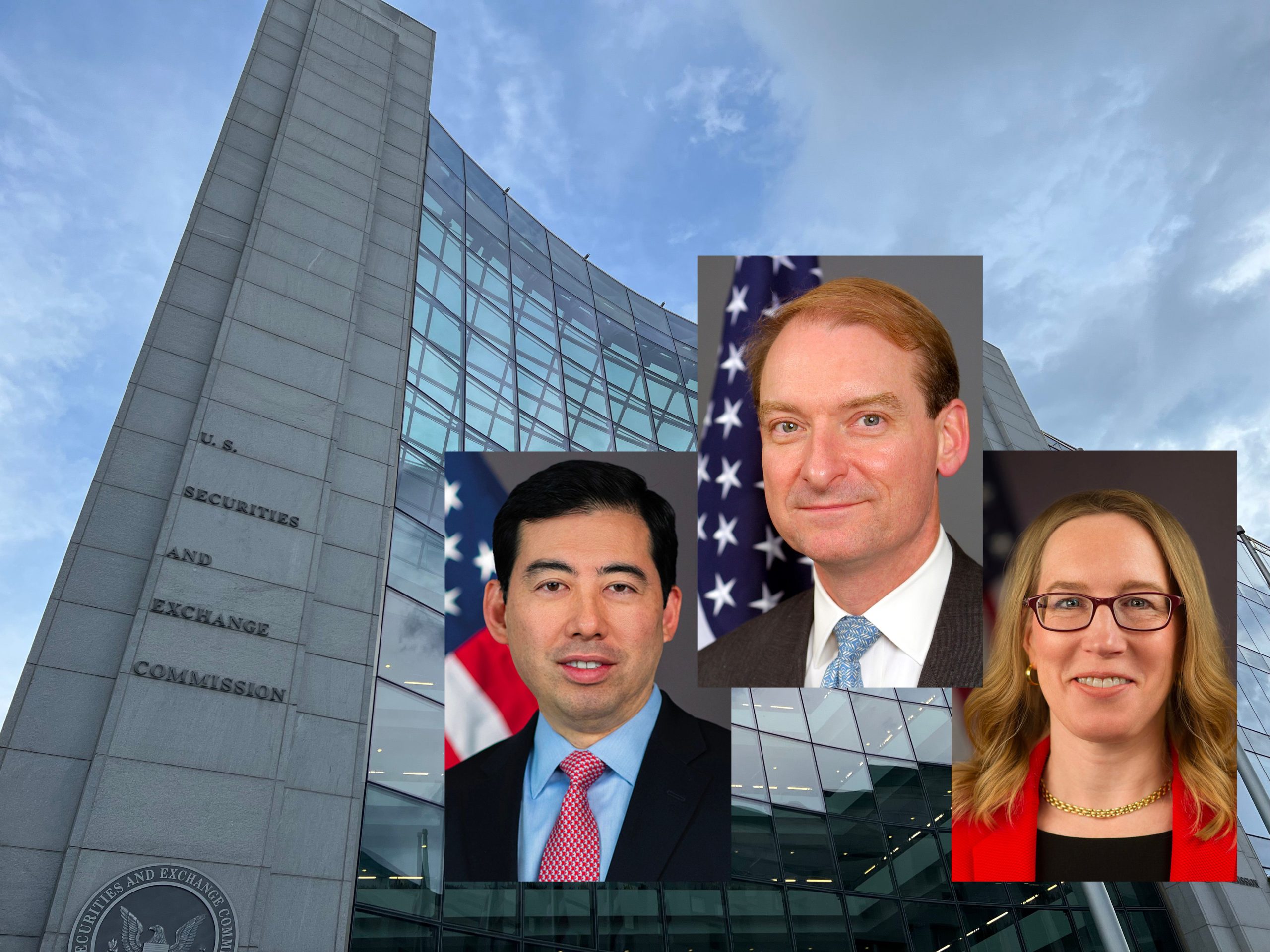

Plume, a blockchain platform focused on real-world assets (RWAs), said on Tuesday it secured an investment from funds managed by ...

Read more© 2025 Btc04.com