Executive Summary

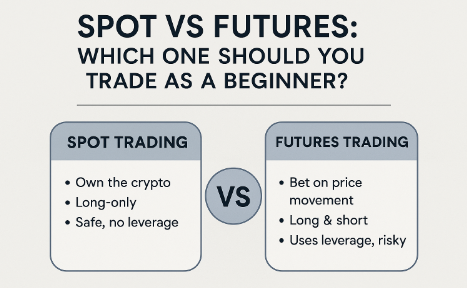

If you’re new to crypto trading, you’ve likely heard about “spot” and “futures” trading. But which is safer? Which one suits beginners better? In this guide, we’ll break it all down — concepts, comparisons, real-life strategies, common questions, and even user feedback — so you can make smart decisions with confidence.

1. Key Concepts Explained

- Spot Trading:

You own the actual crypto asset (e.g., BTC, ETH). You can only profit if the price goes up. There’s no leverage, and your asset can’t be liquidated. - Futures Trading:

You’re betting on the price movement of a coin. You can profit when the price goes up (long) or down (short). Futures use leverage (1x to 125x), but also come with liquidation risk. - Liquidation:

If your futures trade goes against your position too far, your entire margin may be forcibly closed (you lose your money).

2. Real-World Strategy Comparison

Example: $500 Spot vs $500 Futures (3x Leverage)

| Trade Type | Coin | Entry Price | Exit Price | ROI |

|---|---|---|---|---|

| Spot | SOL | $100 | $125 | +25% |

| Futures (3x long) | SOL | $100 | $125 | +75% (but high risk) |

| Futures (3x long) | SOL | $100 | $90 | -90% (near liquidation) |

Takeaway:

Spot gives you time and safety. Futures gives you speed and power — and danger.

3. Pros & Cons Comparison Table

| Feature | Spot Trading | Futures Trading |

|---|---|---|

| Ownership | Yes | No |

| Leverage | No | Yes (1x–125x) |

| Can Short? | No | Yes |

| Liquidation Risk | None | High |

| Suitable For | Beginners | Intermediate to Advanced |

| Emotional Pressure | Low | High |

| Typical Use | Long-term, DCA | Scalping, Hedging, Day trading |

4. Top 5 Questions Newbies Ask

- Can I lose more than I invest in spot trading?

No. You can only lose what you invest — no more. - Can I trade futures without leverage?

Yes. Many platforms allow 1x leverage futures for directional control. - Why do people still use futures if they’re risky?

For short-term volatility, hedging, or earning more with less capital — if used wisely. - Is futures trading gambling?

Without strategy and risk control — yes, it is. - How do I know if I’m ready for futures?

If you’ve been profitable with spot for at least 3–6 months and understand market structure, you may try futures with low capital.

5. Simulated User Feedback

- “Spot trading gave me peace of mind as a beginner. No stress, no surprise liquidations.” – EmilyCrypto01

- “I tried 5x leverage futures on BTC and lost $200 in 1 hour. Big lesson learned.” – rookieHODL

- “This guide is gold! Wish I had read this before jumping into futures blindly.” – chartwatcher77

- “Great explanation of pros and cons. I’m sticking to spot for now.” – lowriskLarry

- “Clear, simple, and to the point. Perfect for beginners like me.” – newbieToMoon

6. Final Thoughts & Actionable Advice

If you’re just starting out:

- Start with spot.

- Focus on learning charts, trends, and entry timing.

- Use small capital to test strategies and reduce emotion.

- Once you have a consistent win rate on spot, explore futures with strict risk controls (like 1x–2x only).

Remember: “You don’t have to swing for home runs — just avoid striking out.”

Call to Action (CTA)

- Want more strategy breakdowns like this?

→ Bookmark btc04.com

→ Follow us on [Twitter/Telegram]

→ Subscribe to our free Weekly Trading Tips Newsletter