Executive Summary

Knowing when to buy is easy. Knowing when to sell? That’s the real challenge. Many traders watch profits disappear or ride coins into the ground. In this guide, we break down simple, actionable strategies to help you identify the right time to exit — with gains intact.

1. Key Concepts Explained

- Take Profit (TP):

A price level where you lock in gains. Smart traders use pre-set TP targets instead of guessing. - Stop Loss (SL):

A safety net to limit losses. Set just below key support or invalidation zones. - Trailing Stop:

A dynamic exit that moves up as price increases, helping you ride trends and exit automatically when the trend reverses. - Emotional Selling:

Selling too early due to fear or too late due to greed — usually costly mistakes.

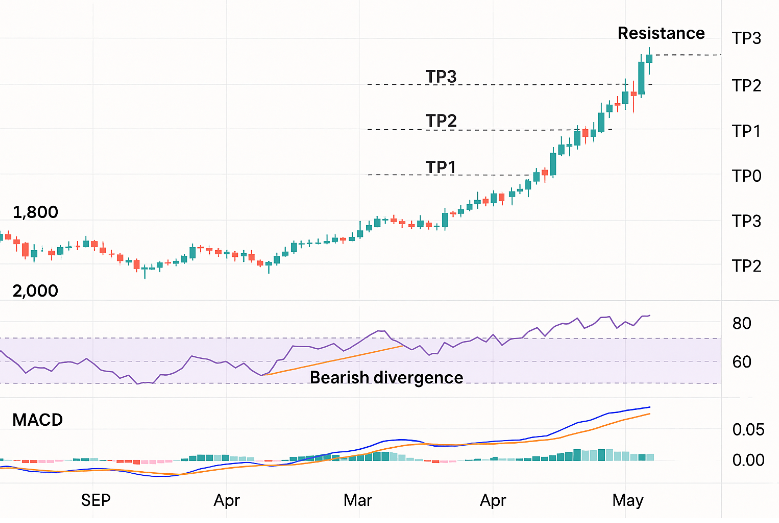

2. Real-World Exit Strategy: The 3-Level TP Plan

Example: You buy ETH at $1,800.

Set Your Exits in Advance:

| TP Level | Price Target | Action |

|---|---|---|

| TP1 | $2,000 (+11%) | Sell 25% |

| TP2 | $2,200 (+22%) | Sell 35% |

| TP3 | $2,500 (+38%) | Sell remaining or move to trailing stop |

This structure locks in profits and lets winners run — without emotion.

3. 5 Signals That It Might Be Time to Sell

- Price hits key resistance level

– Watch for weakening momentum or rejection wicks. - Bearish divergence on RSI/MACD

– Price makes higher high, indicators make lower high → warning sign. - News-driven spike (unsustainable hype)

– If your coin pumps on meme news or celebrity tweets, it’s probably short-lived. - Fundamentals change (negative)

– Hacks, lawsuits, rug pulls, or team exits = time to reevaluate. - You’re unsure why you’re still holding

– If you don’t have a plan, you’re gambling. Exit, reflect, reset.

4. Top 5 Questions About Selling

- What if I sell and it keeps going up?

Happens often. That’s why we scale out in stages. - Is it better to use limit or market orders when selling?

Limit = better control; Market = faster exit. Use limit for TP, market for emergency exits. - Should I sell everything at once?

No. Scaling out smooths emotions and maximizes flexibility. - What if I missed the top?

No one sells the exact top. Your job is to sell well, not perfectly. - What if I’m long-term holding?

Even then, partial profit-taking is wise during parabolic moves.

5. User Feedback

- “Used to ride profits all the way back down. This article changed my habit.” – bagHolderNoMore

- “Take profit in stages? Genius. Makes selling so much easier.” – DCAQueen

- “I set trailing stops for the first time — they saved my AVAX gains.” – trendSurvivor22

- “Thanks for explaining divergence in a practical way.” – technicalTimmy

- “Loved the TP levels table. I screenshot that instantly.” – smartTrader7

6. Final Thoughts & Action Tips

Selling is emotional. But with rules, you don’t need to think twice.

- Set TP levels when you enter

- Watch technical + news-based exit signals

- Don’t aim for tops — aim for consistency

- Journaling your exit logic helps long-term growth

“Buying makes you hopeful. Selling makes you disciplined.”

Call to Action (CTA)

→ Want more exit playbooks and practical trading models?

→ Bookmark btc04.com/trade-smarter

→ Join our “Crypto Exit Masterclass” free series (via email)